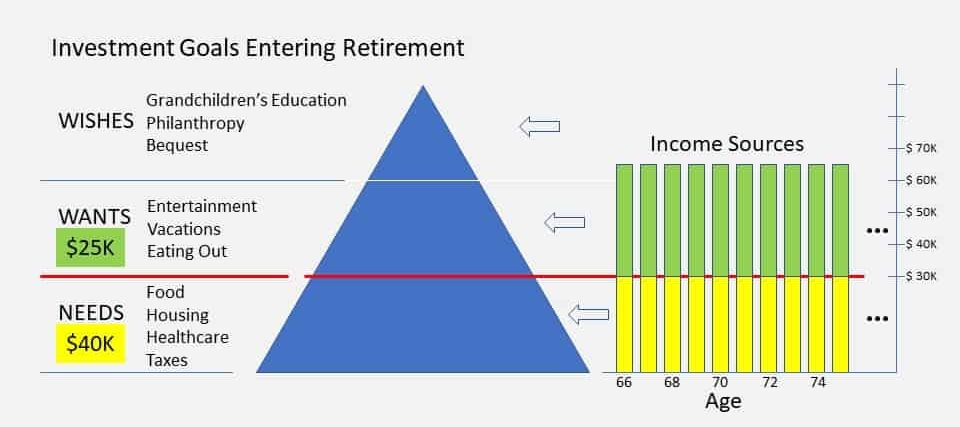

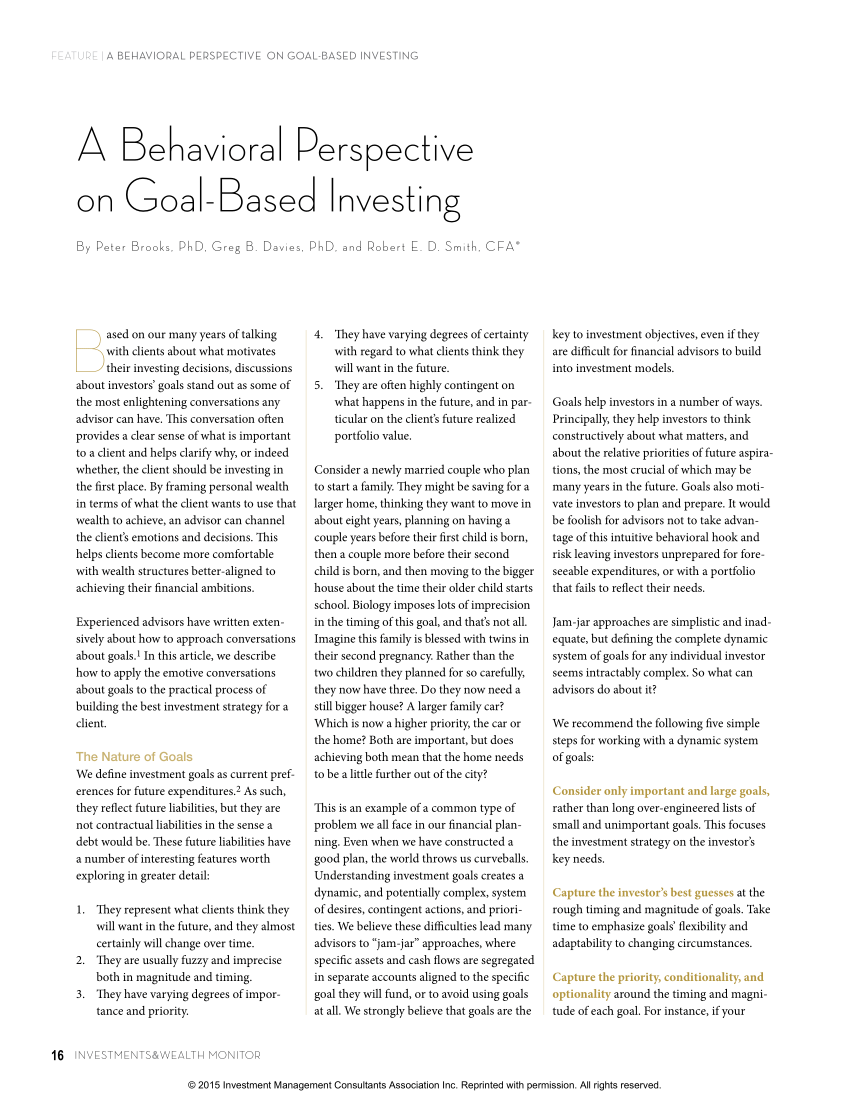

Goal based portfolios are an effective way to mitigate these biases, especially loss eversion and mental accounting Many investment firms talk about behavioral finance and goals based investing But are any really doing it?It is therefore sensible to plan, save, and invest for those future financial goals in advance by putting away some of your current income Goalbased investing is an approach that aims to help you come up with a plan to save and invest current earnings smartly to accomplish a 2 Investing in crypto to grow your wealth Investors in this category are already rich and living comfortably with minimal money pressures And they have raw investment capital of $100,000 to $5 million to play with Their major goal is to put their money to work through lowrisk investments and grow their portfolio gradually

Understanding How To Apply Goal Based Investing Practically Motilal Oswal

Goal based investing pdf

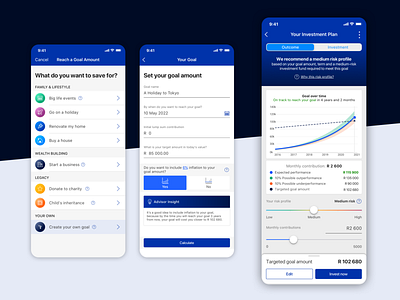

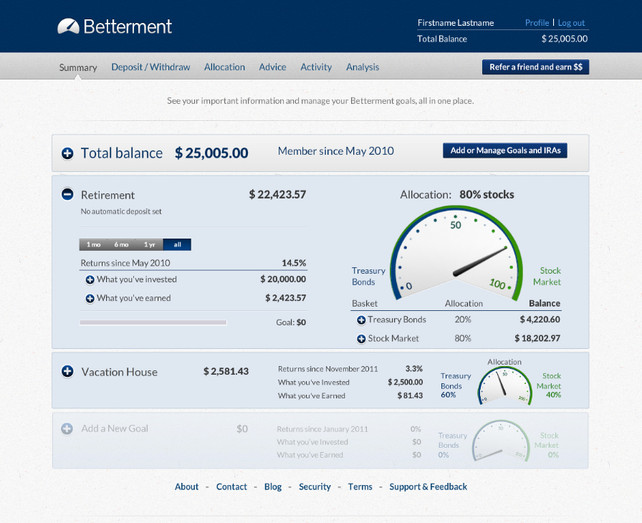

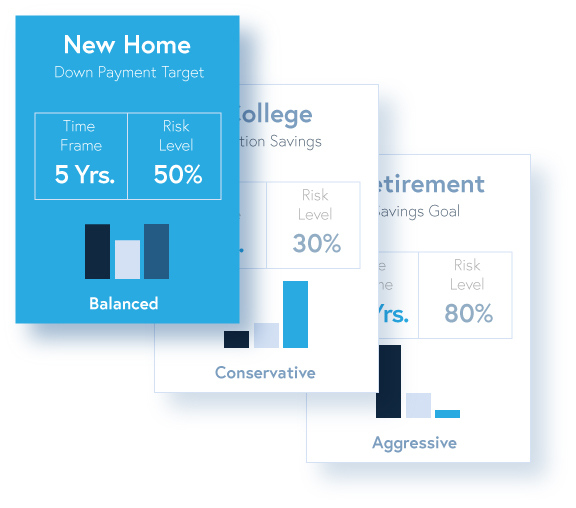

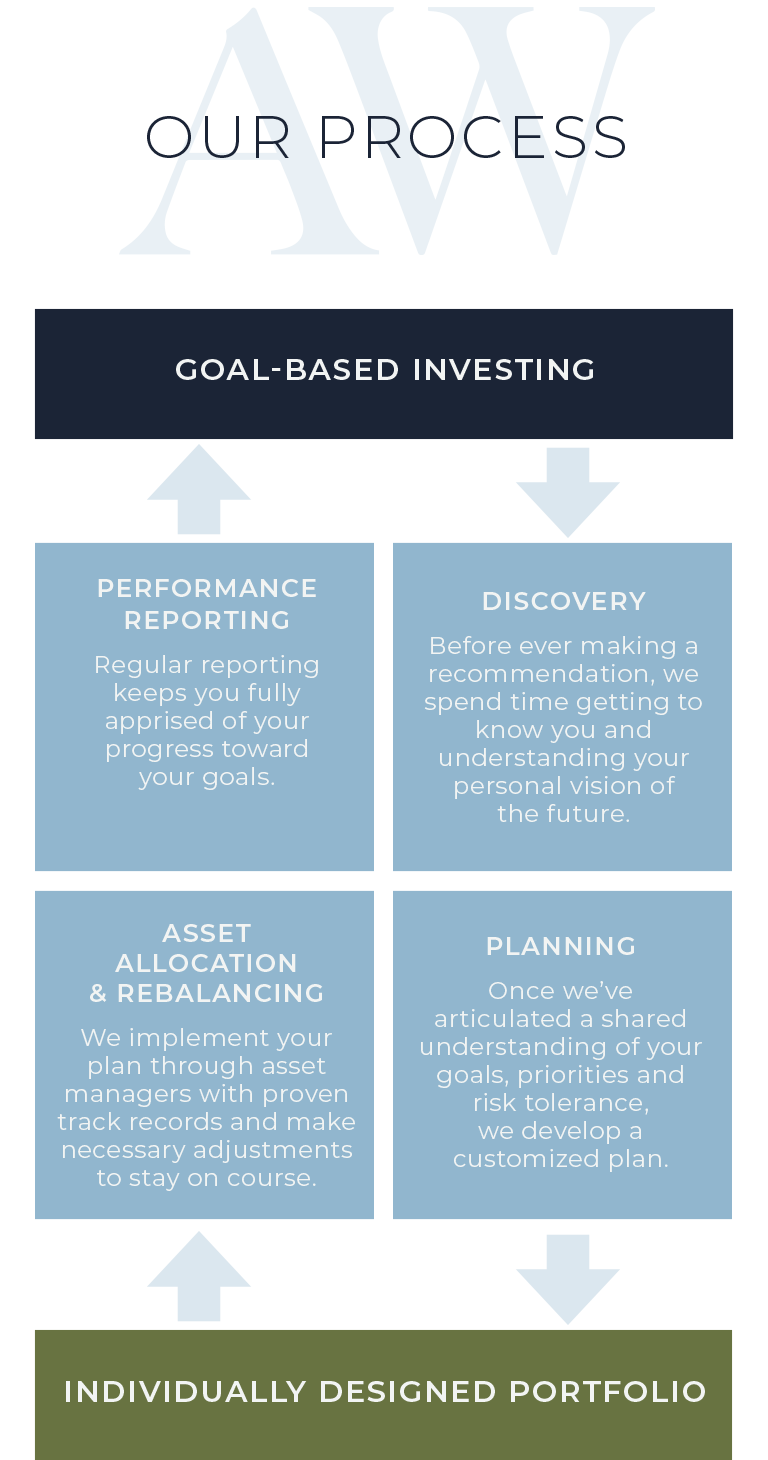

Goal based investing pdf- From there, we create a customized investment portfolio for each of the goals you're investing toward And each portfolio can differ from the others, based on the type of goal you want to achieve For example, a retirement savings portfolio will be very different from a more nearterm Big Splurge goal Goal based investing is based on the premise that financial planning is more effective when you work towards achieving a goal rather than chasing returns A goal based investment strategy first creates a personalised financial goal according to the investor's age, income, expenses, savings and risk appetite

Goal Based Investing Designs Themes Templates And Downloadable Graphic Elements On Dribbble

Goalbased investing refers to investing carefully for specific goals From buying your dream house to taking a world tour, from starting your business to funding your wedding, you may have different dreams Goalbased investing gives you a direction and a Simply put, goal based financial planning is finding a way to align your current money moves with tools to help you reach a specific goal For new investors, this type of financial planning can be especially effective When you're just starting out, investing can feel intimidating and distant Goalsbased investing is a more "clientcentric" process that is focused on measuring progress towards your goals rather than a focus on generating the highest possible return or "beating the market" The process requires investor involvement because you determine your desired tangible outcome and then take the required actions

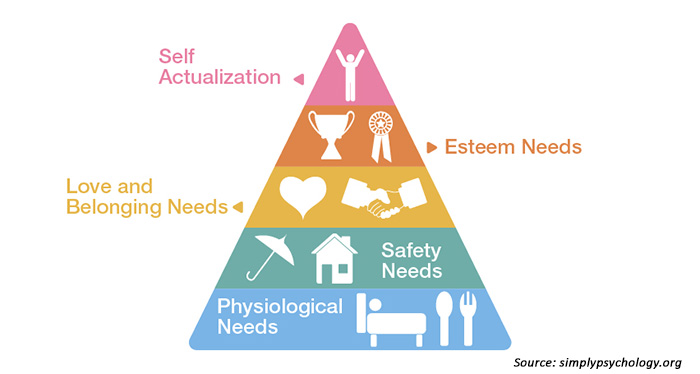

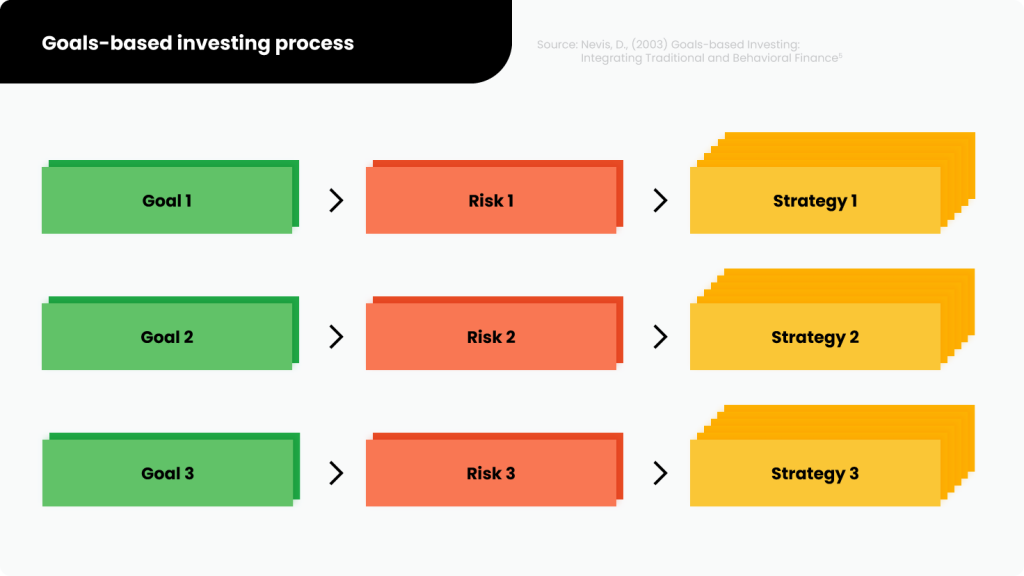

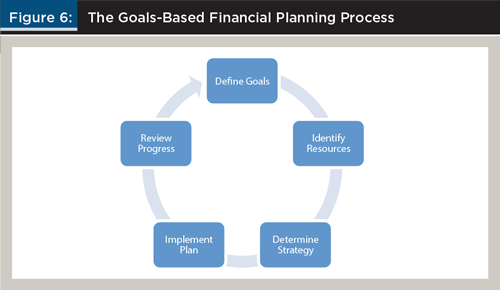

Goalsbased investing empowers intermediaries, institutions and individuals alike to focus on what really matters achieving goals And when you marry those goals with our global economic perspective, it's a powerful framework that Improves on traditional portfolio construction, as it places a larger emphasis on alignment with investor goalsGoalbased investing is a process that makes your investments after setting up goals on what you want to achieve in the future Mapping out all your needs gives you a clearer picture and the time for which you need to stay invested to achieve each goal Even the type of risk you should take will be defined by your goals The goalbased investing planning process comprises 5 phases #1 Define possible financial objectives #2 Identify current and future available resources #3 Determine the appropriate strategy for the distribution of capital between savings and investments, in accordance with their characteristics and personal conditions, and aimed at achieving objectives #4 Implement the plan

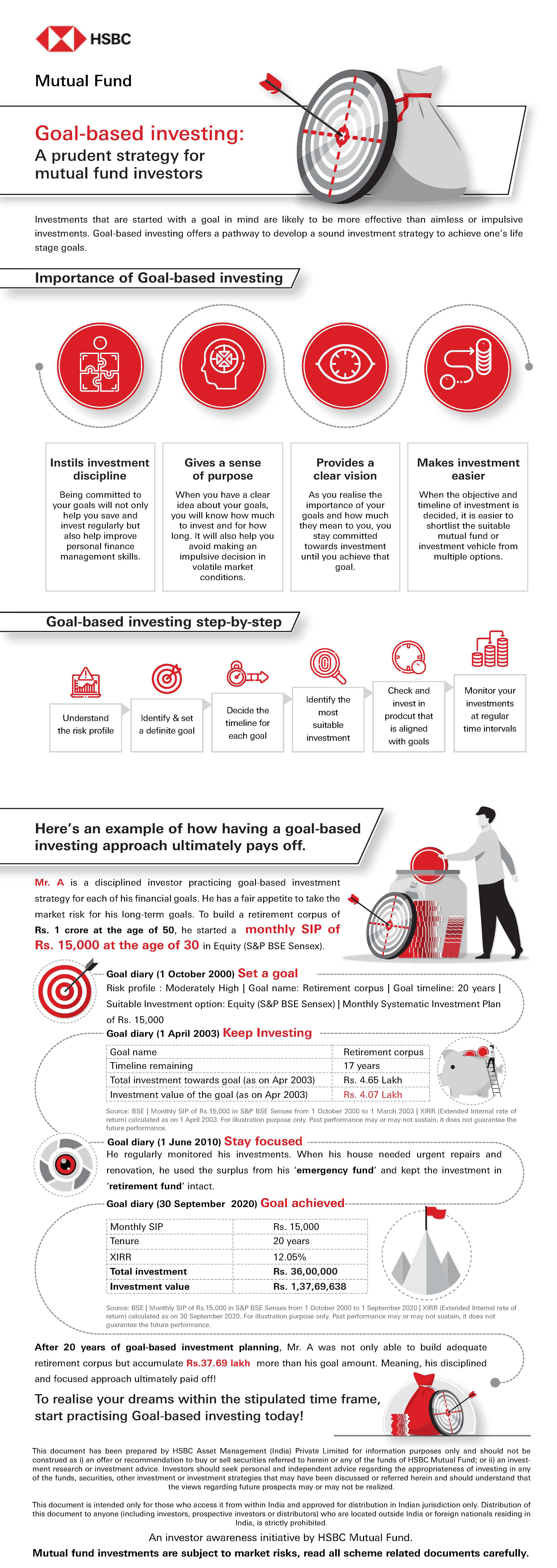

Goalbased investing is an approach to investing that is linked to your financial goals It maps your savings and investments to a fixed goal and is aimed at bringing discipline to your investing method Let's understand some of its benefits 1 Helps to identify the required investment amount to achieve your financial goalsGoalbased investing (GBI) implements dedicated investment solutions to generate the highest possible probability of achieving investors' goals, with a reasonably low expected shortfall in case of adverse market conditions Related Content Publications Assume a reasonable inflation rate (not the historical average) The higher the safer Using 1 and 2, determine how much the goal would cost at the time of need Determine how much you can invest after taking into account expenses, loans, investment towards retirement (always the Estimate how

Goal Based Investments Service Investment Service Bm Fiscal Point Advisors Pvt Ltd Pune Id

What Is Goal Based Financial Planning Peak Financial Services

Investing in a systematic manner is one way to achieve these goals Giving your investments a target to achieve, on the other hand, helps you appreciate the importance of your investment Goalbased investing is a method of making investments after determining what you want to do in the future How to make Moneyfy goalbased investing work for you To understand how Tata Capital's Moneyfy app can help you with goalbased investing, let's use some examples Say, you choose your investment goal as 'Vacation' and want to save Rs 5 lakhs for a trip to Singapore over the next 3 years and 6 months As the name suggests, goalbased investing is planning and making investments to achieve specific life goals With a robust financial plan in place, your goals will be realized for sure This concept may sound novel, but goalbased investing has been around for a while An example of goalbased investing can even be derived from Kanchivaram a

Why Practicing Goal Based Investing Is Essential For Small Investors

Goal Based Investing How To Fund Your Goals U Optomatica

Position your clients' wealth to realize their financial goals with Horizon's breakthrough goalsbased investing program Goalsbased investing See our approach to measuring risk in goalsbased investing Confidently manage risk at every investment stage Risk redefinedFactors to Consider While Selecting the Best Investment Options While planning your investment, you need to figure out the right investment option which fits your risk tolerance and financial goals It should give you the desired return while also achieving your financial goals Successful goalbased investing revolves around this simple acronym A good SMART financial goal would be to pay off $10,000 of student loans over 4 years This goal fulfills SMART standards since it's specific, measurable ($10,000 instead of a vague goal of paying off student debt), and timely (in 4 years)

You Can Be Rich With Goal Based Investing Janusworx

Standard Bank Save Invest Robo Advisor By Marli Terblanche On Dribbble

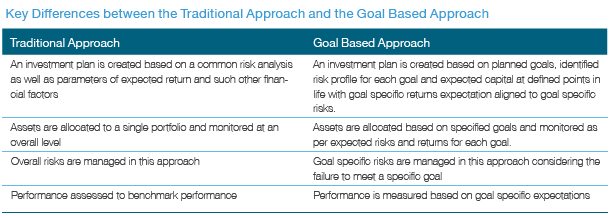

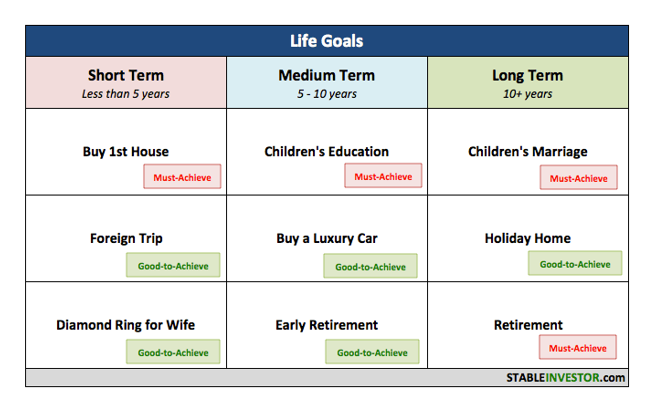

Goalbased investing examines your goals and assigns each a separate investment strategy relative to the goal's importance, time horizon and level of risk with which you are comfortable PERFORMANCE is measured as progress toward achieving each goal, rather than returns compared to an arbitrary benchmarkGoalbased investing is all about identifying your financial goals, setting a timeline for each one of them, and investing for them regularly to be able to reach them So essentially, you give all your dreams and financial goals a structureGaining clarity about your intentions and commitments is the first step to living the life you want The unique approach Goldman Sachs Personal Financial Management takes to goalbased investing focuses on the importance of you and your financial advisor understanding the

Where There S A Goal There S A Way Goal Based Investing

I Have Heard Of Goal Based Investing What Now Arthgyaan

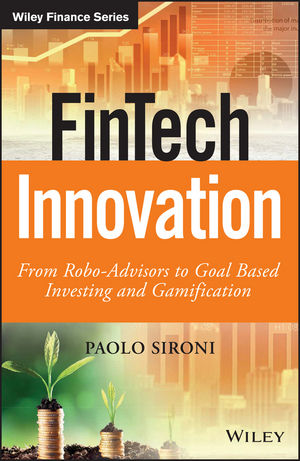

Horizon Investments offers an innovative goalsbased investing program with corresponding model portfolios, platform tools, mutual funds, and ETFsOur Gain Protect Spend® framework is designed to optimize financial planning as investment goals and risks change throughout your client's life or investment journey Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets andInvestment goals than a simple one Asking people t o selfreport their investing goals is insu cient About 26 percent of the participants in the study changed their top goal when prompted with reminders about other goals On a verage, using a more sophisticated ranking technique did not lead to any appreciable di erence in how investment

I Am Now Ready To Do Goal Based Investing What Now Arthgyaan

Goal Based Investments Financial Planning Guide Advisors

What is the meaning of goal based investments Every individual has financial goals that he needs to reach in the short, medium or long term period Investing regularly to be able to reach the respective financial goal is called goalbased investing For example, if you plan to buy a car in next 23 yeas, it can be called a shortterm goal Simply log in and select my portfolio Then choose from goalbased investing or general investing Then select the fund you wish to sell and click withdraw Please note once you click withdraw, the full investment amount held in that particular fund will be sold You can't sell part of your investment Goal based financial planning is simply a structured approach to goal based investing that can ensure a much higher chance of success in meeting your financial goals It is always recommended to engage a financial planner or advisor , if you think you need help

Goals Based Investing Suggested As Replacement To Advisers Traditional Approach Ardent Wealth

Goal Based Investing Through Mutual Funds Youtube

Goalsbased investment theory not only acknowledges these goals, it provides budgets and portfolios for them In the end, goalsbased investing is simply about using financial markets to achieve your goals under realworld constraints But that can only happen by first understanding and modeling the objectives you're actually trying to achieve Goal based investing is a powerful method which can help you against market fear and uncertainty by better managing your financial preferences Investing according to your unique goals and time horizons encourages you to look beyond shortterm market volatility and help you stay invested for long term Goalbased investing is an investment strategy that is more precise, greater detailed, and attaches something personal and important to you It simply forces us to think about what matters most in our lives Each account has its own unique plan to accomplish a particular goal by a certain date, with its own unique portfolio allocation and

Goal Based Investing Gbi Edhec Risk Institute

Goal Based Investing Quantifeed

Goalbased investing is the best way we know to help you set a personalized financial plan with investments that are aligned to help you fulfill that plan over the longterm You can think of goals as the building blocks of a plan When you set goals for your investments, you're identifying what personal purpose you have for your money, andGoalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifyingDrive outcomes across the wealth curve Horizon's purposebuilt, academicallyrigorous goalsbased investment products are designed to optimize portfolios as investor goals and risks evolve during the investment journey Introducing Horizon's unique goalsbased approach We call it GAIN PROTECT SPEND®

Learn More About Goal Based Investing Today Iinvest Solutions

Eton Advisors Wealth Management

Goalsbased investing is an approach which aims to help people meet their personal and lifestyle goals, whatever they may be, in a straightforward and simple way It does this by placing people's goals right at the centre of the advice process and aims to Goalbased investing is an investment approach that considers one's end financial goal, hence helping the investor make investments that complement the end goal By linking the investments to a goal, the aim of this approach is to systemize savings over a specific duration to yield expected results In this article we would detail about Goal Based Investment approach Goalbased investing rationale, benefits and guidelines Goalbased investing the planning process, in practice Why we need to invest, and savings aren´t enough Search this website Newsletter Subscribe to our mailing list Recent Posts

Goals Based Investing The Cnr Way A Fresh Take On An Established Approach

You Can Be Rich Too With Goal Based Investing Home Facebook

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities Before investing, consider your investment objectives and Betterment LLC's charges and expenses Betterment LLC's internetbased advisory services are designed to assist clients in achieving discrete financial goals Investment plan for goalbased wealth creation;This discussion will dive into the realities of goals based investing from a behavioral finance perspective

Why Practicing Goal Based Investing Is Essential For Small Investors

Goal Based Investing Designs Themes Templates And Downloadable Graphic Elements On Dribbble

GoalBased Investing Research is conducted by experienced wealth managers and investment firm's clients It involves checking the progress of the GoalBased Investing strategy and how much it has supported in achieving the specific life goals Goalbased investing is better because it is a SMART (specific, measurable, attainable, relevant

Investment Accelerator Goal Based Investing Software Planning

The Power Of Goal Based Investing First Republic Bank

Goal Based Investment Planning Retirement Planning Example And Video

Horizon Investments Goals Based Investing

Pdf A Behavioral Perspective On Goal Based Investing

:max_bytes(150000):strip_icc()/ellevest-vs-betterment-ebf2bcde1eec4958969a2d2171f2687c.png)

Goal Based Investing Definition

Goal Based Investing Blog Central Investment Advisors

What Is Goal Based Investing Baraka

Are You Investing Towards Your Goals Boston Private

Real Success With Goals Based Investing Proactive Advisor Magazine

I Am Now Ready To Do Goal Based Investing What Now Arthgyaan

Principle 8 Match Your Strategy To Your Goals Washington Crossing Advisors

Diy Stock Investing Vs Goal Based Investing Tbng Capital

Goal Based Investing Platform Fountain Raises First Seed Round Startacus

What Is Goal Based Investing Why It Is Important For You Kuberverse

Goals Based Investing An Approach That Puts Investors First

Goal Based Fintech A Review Of Fintech Innovation By Efi Pylarinou Medium

What Is Goals Based Investing And How Does It Work Manulife Private Wealth

9 Ways Goal Based Investing Leads To Success Betterment

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

Smart Investing Asset Allocation In The Time Of Coronavirus Crisis The Financial Express

Betterment Review Get Motivated With Betterment S Goal Based Investing The Humble Broker

What Is Goal Based Financial Planning Anyway Stable Investor

Goals Based Investing An Approach That Puts Investors First

The Value Of Setting Investment Goals Mintos Blog

1

Fintech Innovation From Robo Advisors To Goal Based Investing And Gamification Wiley

Goal Based Investing Plan Ahead Simplifying Your Financial Life

Where There S A Goal There S A Way Goal Based Investing

Dimensional Fund Portfolios Flat Fee Investing Derive Wealth

Invest With Goals In Mind

Why Practicing Goal Based Investing Is Essential For Small Investors

Goal Based Investing Wikipedia

Goal Based Investing Process Investment Benefits Wiseradvisor Infographic

Practicing Goal Based Funding Is A Should India Dictionary

Investment Management Integrated Wealth Management Financial Planner Investment Management Seattle

Plan Your Financial Life With Purpose The Importance Of Goal Based Investing

Why Practicing Goal Based Investing Is Essential For Small Investors

Goal Based Reporting Tools For Investment Advisory Firms

Financial Success Using Goal Based Investment Key To Success

Goals Based Investing And Why It Matters Endowus Sg

Understanding How To Apply Goal Based Investing Practically Motilal Oswal

Goals Based Investing For Affluent Families And Individuals Sei

Xeno Investment A Dream Is Just A Dream A Goal Is A Dream With A Plan And A Deadline Come Learn About Goal Based Investing With Xeno It Will Change Your

Goals Based Investing Should It Be The Norm Cfa Institute Enterprising Investor

Why Practicing Goal Based Investing Is Essential For Small Investors

Learn More About Goal Based Investing Today Iinvest Solutions

Why Goal Based Investing Is The Key To Gain Returns Sheroes

Goal Based Investing The Planning Process In Practice Investorpolis

Goal Based Investing Rationale Benefits And Guidelines Investorpolis

:max_bytes(150000):strip_icc()/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

Goal Based Investing Definition

Goals Based Investing Private Wealth Partners

Goal Based Investment Planning

Goal Based Investing Through Mutual Funds Mymoneysage Blog

Goal Based Investing Alpha Wealth Advisors Llc

What Is Goal Based Investing Baraka

1

Goal Based Investing Ppt Powerpoint Presentation Outline Outfit Cpb Powerpoint Slide Presentation Sample Slide Ppt Template Presentation

Educational Infographics

Use Private Equity Real Estate To Meet Personal Investment Goals

You Can Be Rich Too With Goal Based Investing By P V Subramanyam

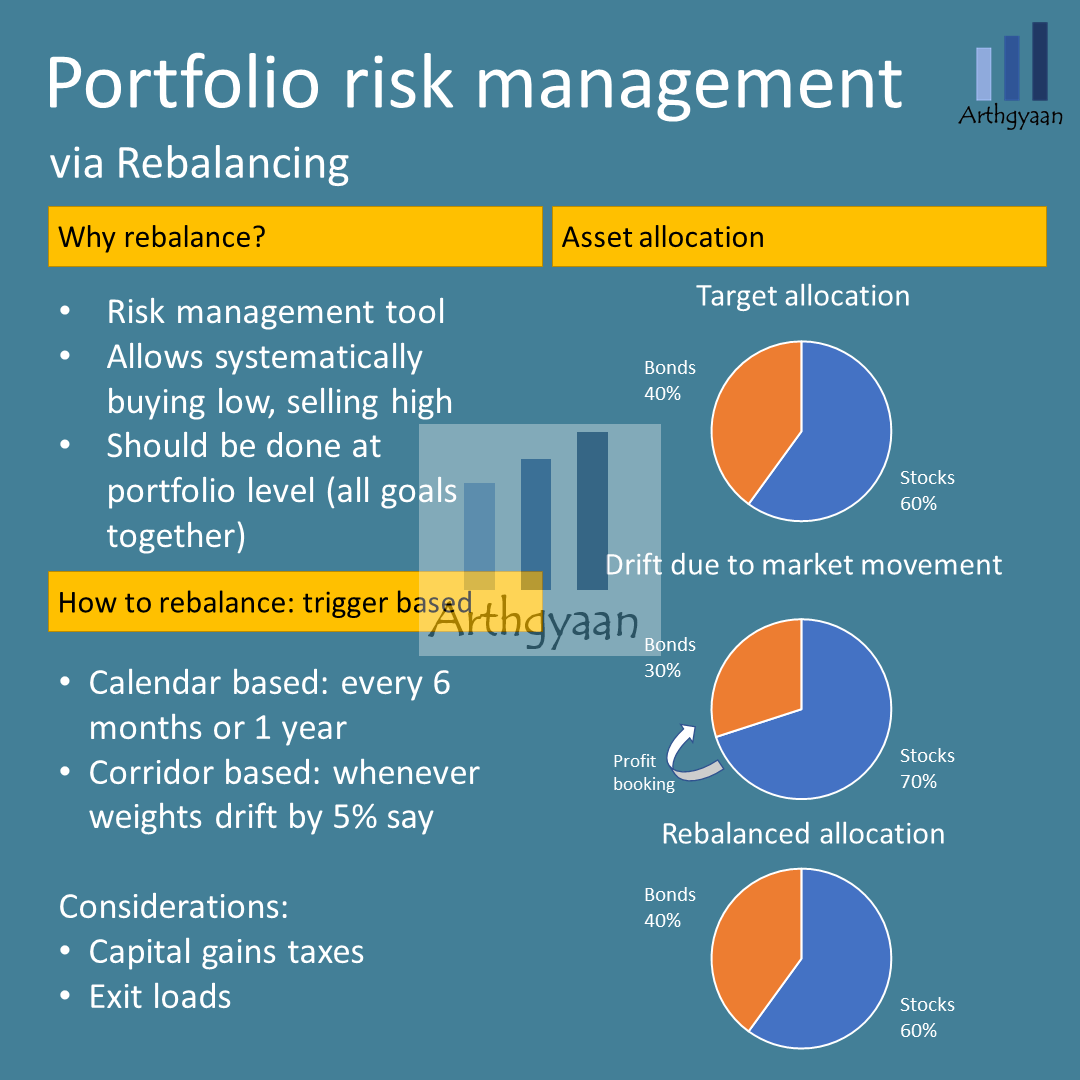

Portfolio Rebalancing During Goal Based Investing Why When And How Arthgyaan

Learn More About Goal Based Investing Today Iinvest Solutions

Rankmf Baskets The Best Approach To Goal Based Investing

Likeassets 101 Goal Based Investing Strategies Youtube

Your Money Why Volatility Is A Friend In Goal Based Investing The Financial Express

1

Goal Based Investing Innovative Use Of Established Methods 3rd Eyes Analytics

Using Investment Goals At Betterment Goal Based Investing Advice

What Is Goal Based Investing Forbes Advisor India

The Power Of Goal Based Investing First Republic Bank

Three Pillars Of Goal Based Investing First Rate

A Framework For Goals Based Investing Boston Private

1

:max_bytes(150000):strip_icc()/wealthfront-vs-td-ameritrade-essential-portfolios-072e85eb93f449cab08317a9625d8776.jpg)

Goal Based Investing Definition

Applying Goal Based Investing Principles To The Retirement Problem Edhec Risk Institute

Eton Advisors Wealth Management

Goal Based Investing How Does It Work Everyfin Newsletter

Learn More About Goal Based Investing Today Iinvest Solutions

Factor Investing In Liability Driven And Goal Based Investment Solutions Edhec Risk Institute

Where There S A Goal There S A Way Goal Based Investing

Goal Based Investing Romain Deguest Blackwell S

Goal Based Investing And Application To The Retirement Problem Edhec Risk Institute

0 件のコメント:

コメントを投稿